executive summary

Today, the Council of Social Security and Medicare has published an annual report detailing the financial status of the two largest qualification programs in the United States. The report reflects past conclusions: Social Security and Medicare are still bankrupt.

Medicare goes bankrupt at the current pace 2028 And the Social Security Trust Fund for old-age benefits and disability benefits 2035..

A quick glance at the data shows how broken the current entitlement program is. An American Action Forum analysis of the data found other amazing statistics, including:

- Medicare’s annual cash shortage in 2021 was $ 409 billion.

- In order to pay for Medicare Apartment A in 2021, the payroll tax had to be raised by almost 18 percent.When

- Over the next 75 years, social security will borrow $ 20.4 trillion more than expected.

What you need to know about Medicare and Social Security Trustee Report Contains one-page pager and related statistics for:

- Medicare solvency;

- Medicare Presidential Management;

- Social Security Trust Fund solvency;

- Ability to pay for social security disability insurance (DI) programs.When

- Ability to pay for social security old-age insurance and survivor insurance (OASI) programs.

This week, Treasury Secretary Janet Yellen released the 2022 Medicare Fiduciary Report. This annual report further reminded the American people that Medicare was definitely bankrupt.

The report estimates that the Medicare Hospital Insurance Trust Fund will go bankrupt by 2028. Bankruptcy predictions may catch headlines, but there are three important budget figures that shouldn’t be overlooked.

|

$ 490 billion |

Medicare’s annual cash shortage in 2019

|

|

$ 6.4 trillion |

Medicare’s cumulative cash shortage since 1965

|

|

29 percent |

Medicare’s True Contribution to National Debt

|

It is unacceptable to continue the status quo of Medicare. Balancing Medicare’s annual cash shortages under the existing system proves to be devastating to the elderly, and failure to reform the status quo will have the following implications:

|

18 percent increase |

Annual salary-tax increase required to balance Medicare Apartment A

|

|

$ 4,728 increase |

Increased annual premiums required to balance Medicare Apartment B

|

|

$ 1,953 increase |

Increased annual premiums required to balance Medicare Apartment D

|

Evaluation of Medicare Stewardship of Government Agency

Each year, the Board of Trustees report provides a nonpartisan assessment of the president’s management of Medicare. The Board of Trustees report, produced annually for Congress by the Supreme Actuary Office, provides unparalleled details on the financial operations and actuarial status of the Medicare program. In short, it’s where the soaring Medicare rhetoric of all governments meets the financial reality. So far, President Biden has resisted embarking on important Medicare reforms. The 2022 Board of Trustees report provides a sense of what the future holds if Medicare remains unchanged, and why Medicare reform is inevitable sooner or later.

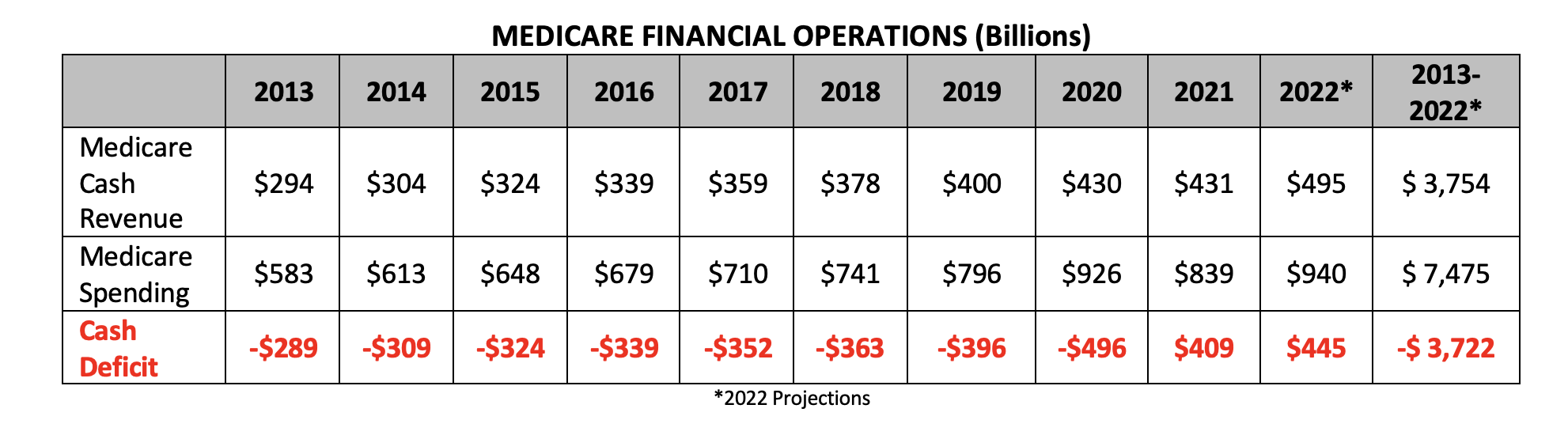

Medicare Finance (Billions)

The Obama administration has overseen a $ 2.4 trillion cash shortage for eight years (2009-2016). The Trump administration oversaw its $ 1.6 trillion Medicare cash shortage during this presidential term. The financial reality is that continuing the Medicare policies of the previous two governments and leaving Medicare unchanged is all but guaranteeing bankruptcy. The Board of Trustees predicts that President Biden will oversee a $ 854 billion cash shortage even during his first term.

With this unprecedented level of cash shortages continuing within budget, maintaining the status quo will soon eliminate Medicare for future generations of Americans, as well as today’s older people. Is guaranteed. These rising costs and the steps needed to cover them will do more and more harm to the elderly if Medicare reforms are not implemented.

| Medicare and Medicaid will cost $ 2 trillion by 2024 | Medicare costs continue to rise

|

This week, the board overseeing the social security program released its annual report. The report shows that the financial outlook for the state’s major safety nets for retirees, survivors, and persons with disabilities would not be able to fulfill its promises to future seniors without meaningful reforms. I am.

The report estimates that the combined Social Security Trust Fund (for retirement and disability) will be exhausted by 2035, a year later than last year’s estimate. The Board report reveals a structural imbalance in programs that endanger the retirement benefits of millions of working Americans.

|

$ 126.4 billion |

Social Security Contribution to 2021 Debt

|

|

$ 20.4 trillion |

75 years of unfunded responsibility for social security

|

|

13 years |

Number of years until the trust fund is used up

|

The Board report depicts the dire situation of social security financial conditions and shows that the current course is unsustainable. Social security is currently contributing to the annual deficit, but promised profits exceed planned funding by more than $ 20 trillion.Meaning of failure to reform status quo that is:

|

20 percent |

Decrease in profits in 2035

|

|

26 percent |

Payroll tax increase

|

This week, the board overseeing the social security program released its annual report. The report reflects the ongoing improvement in the outlook for the disability insurance (DI) program.

Report by DI Trust Fund solvent In the long run.. This outlook is the first time the program has been sustainable for a long time since 1983. The program faces recent solvency challenges and required payroll tax reallocation in 2015.

|

$ 85.3 billion |

10-year contribution to DI debt

|

|

-$ 56 billion |

DI Unfunded 75-Year Debt

|

The Board report reflects a significant decline in the outlook for the US safety net for disabled workers.

This week, the Board of Trustees, which oversees the social security program, released an annual report. The report shows that the Old Age and Survivor Insurance (OASI) program remains unsustainable and cannot meet the needs of future beneficiaries without reform.

The report estimates that the OASI Trust Fund will be exhausted by 2034. The report also reveals some additional structural challenges that endanger millions of current and future retirees and survivors who depend on this program.

|

$ 126.5 billion |

OASI’s contribution to debt in 2021

|

|

$ 20.5 trillion |

OASI’s Unfunded 75-Year Debt

|

|

12 years |

Number of years until the OASI Trust Fund is exhausted

|

|

71.6 million |

Number of beneficiaries in 2034 (year of trust fund depletion)

|

The Board report reveals that major federal retirement programs remain unsustainable. In the current course, the program will reduce severance benefits for more than 71 million Americans or significantly raise taxes on future workers.