Health insurance can be expensive, which has led many to go without health insurance. By 2020, 28 million people were not insured at any point in the year, according to the US Census Bureau.It’s not hard to believe Health insurance costs The average cost of family planning exceeded $ 22,000 a year in 2021 and continues to sneak up.

With high costs and seemingly less transparent medical costs, it’s no wonder Americans are looking for new ways to pay for medical services. This guide describes five options for shopping on the Federal Health Insurance Exchange and how to save on medical costs without giving up the profits you need.

read more: Best Life Insurance Company in May 2022

Cost sharing plan

A cost-sharing plan groups people together to pool medical costs and, as a result, reduce payments. With the cost sharing plan, you will be required to pay a monthly or annual membership fee. When you go to the doctor, you pay another fee (like out-of-pocket), and your organization covers your remaining medical expenses. Cost-sharing groups work with doctors and hospitals to negotiate fees, and monthly fees are often cheaper than traditional premiums.

Many cost-sharing plans are religious or religious, and members must adhere to certain lifestyle beliefs. Medi-Share, for example, is a Christian cost-sharing organization with a national network, and members must “have Christian testimony to show their personal relationship with the Lord Jesus Christ.” In some cases, these groups may not cover medical costs associated with activities that are considered unacceptable, such as the treatment of sexually transmitted diseases resulting from extramarital sex.

However, there are many benefits to being eligible for membership and adhering to the types of lifestyles required by cost-sharing organizations. Medi-Share offers 24/7 telemedicine, access to over 900,000 providers nationwide, prescription discounts and additional savings. Select a procedure. Other cost sharing plans include Samaritan Ministries, Sedera Health, and Liberty Health Share.

Off-exchange insurance

You can find more affordable insurance by purchasing directly from your broker or insurance company. Off-exchange insurers are trying to make it easier to find the right health insurance for their specific needs and lifestyle, and to make the infamous and complex process mind-boggling. necessary.

Oscar, for example, is a technology-based health insurance startup that provides health insurance to individuals, families, and small businesses. The company offers bronze, silver, gold and platinum plans. These plans offer the same benefits, but with different deductible and premium costs. The monthly fee for the bronze plan will be lower, but the amount paid for medical services will be higher.

Oscars and most off-exchange plans have additional benefits not available with federal plans, such as Oscar’s 24/7 “Doctor on Call” feature and the ability to chat with registered nurses via the Oscar app. .. question. Other compelling benefits, such as the step-tracking cashback partnership between Oscar and Google Fit and Apple Health, make the off-exchange program even more compelling.

If you don’t want to buy insurance on a federal exchange, try an off-exchange broker or provider.

Getty Images

Health Pocket, Hooray Health Care and eHealth Insurance are other examples of off-exchange health insurance brokers. Off-exchange plans usually meet the requirements for Affordable Care Act, but be sure to check before registering.

Professional Associations and Industry Associations

You may be able to find a cheaper health insurance plan by joining a group or organization. For example, the American Self-employed Association offers many insurance benefits to small business owners, entrepreneurs, and sole proprietors.

Many industry groups, professional organizations, and alumni associations work in the same way as cost-sharing plans. Because it is grouped with other members of the organization, costs are pooled and reduced. Find an association of professionals with insurance benefits in your industry-you may be surprised at the plans and rates you find.

You can also contact your state insurance department to find a group plan that meets your ACA requirements.

Professional associations may help save money by sharing costs with other members.

Getty Images

Health discount card

Health discount cards are technically not a substitute for insurance. It is for people who are planning to pay cash for health services when costs are incurred. Also known as a “medical service discount card,” it can be used for a variety of services at different types of health centers.

You can pay a one-time membership fee or a small monthly fee for these cards, but the discounts are considerable and can be as high as 50% or more in some cases. However, not all health discount cards are charged. WellCard is a free health discount program with national access to both primary care providers and professionals.

As with traditional insurance plans, health discount cards often have network restrictions, so check with your local participating provider before signing up for the card. Don’t be surprised by the list price invoice.

Health discount cards are for those who want to pay in cash when they need care.

PhotoAlto / Frederic Cirou / Getty Images

Telemedicine

Telemedicine, like health discount cards, is not a true alternative to insurance, but it may be the answer to many problems. If you don’t have the resources to meet your doctor directly, such as money, insurance, transportation, or time, you can take advantage of low-cost telemedicine services to receive a diagnosis or prescription without insurance.

Many telemedicine companies accept insurance if they have insurance, but the cost of seeing a virtual doctor is higher than the cost of going to a physical clinic without insurance (and in some cases even with insurance). Will be much cheaper. Convenience is another important element of the telemedicine boom.

Of course, telemedicine can’t do everything-in many situations it requires a face-to-face specialist-but at a low cost for easy-to-treat problems such as common colds, migraines, STD tests, and pink eyes. Useful as an alternative.

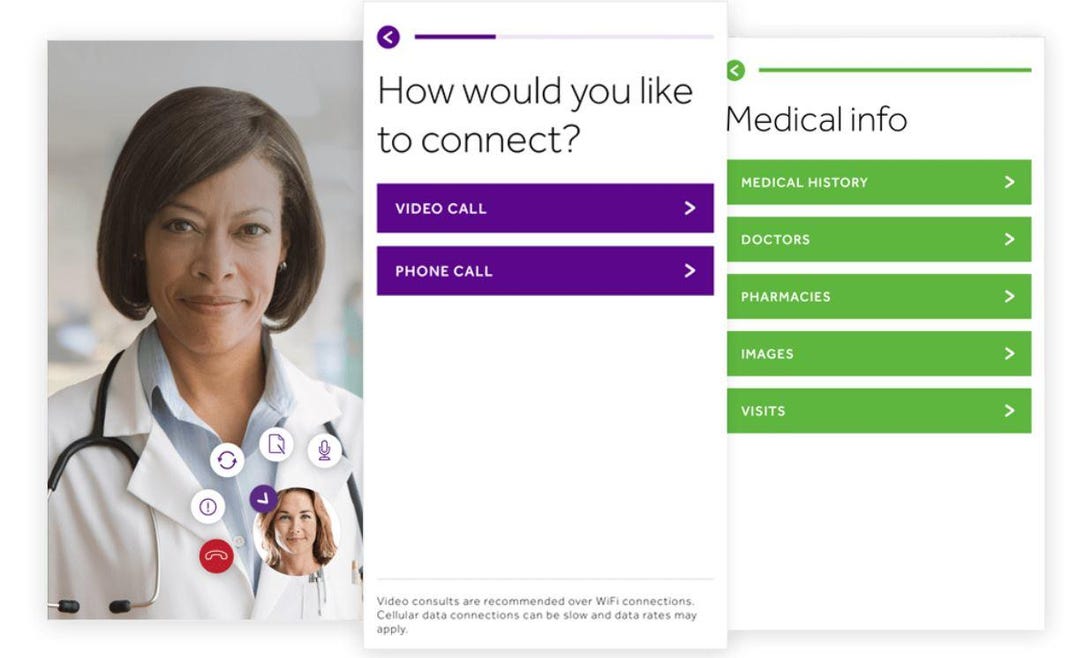

Most telemedicine apps and websites allow you to choose from video, phone, or text to chat with your doctor.

Terra dock

Take out

Health insurance is expensive and cumbersome, and many cannot afford or want to take out traditional health insurance through ACA. Therefore, as medical costs continued to rise, people came up with ways to take care of themselves without shopping on the federal exchange.

The benefits of these alternative insurances vary and may not be suitable for everyone, but they can be a viable solution if traditional health insurance is not an option. Whenever you sign up for another method, be sure to read the fine print to understand what you’re getting and what you’re not getting.